portfolio

Reflecting good operating performance, the key figures for the first half of 2024/25 were generally positive. Letting activities and contract extensions with existing tenants led to a decline in the vacancy rate to 6.6% at 30 September 2024 and a 2.5% increase in rental income compared with the same period in the previous year.

Active Asset Management

The letting successes already communicated at the end of the last financial year became effective in the first half of 2024/25. As expected, this was reflected in a significant improvement in the key figures as at 30 September 2024. Rental income rose by 2.5% year-on-year to CHF 4.6 million and increased from CHF 9.2 million to CHF 9.6 million on an annualized basis. At the same time, the vacancy rate in the portfolio fell from 9.3% to 6.6%.

The completion of investments in properties and higher rental income resulted in an increase in the value of the portfolio at the valuation date, despite the ongoing subdued market situation. At CHF 225.9 million, the valuation was 0.3% or CHF 0.8 million higher than at the last valuation date of 31 March 2024. The average weighted discount rate remained unchanged at 4.35%.

Key Portfolio Data

Properties at a Glance

Sucessful Asset Management

Decrease in vacancy rate from 9.3% to 6.6%

Letting Activities

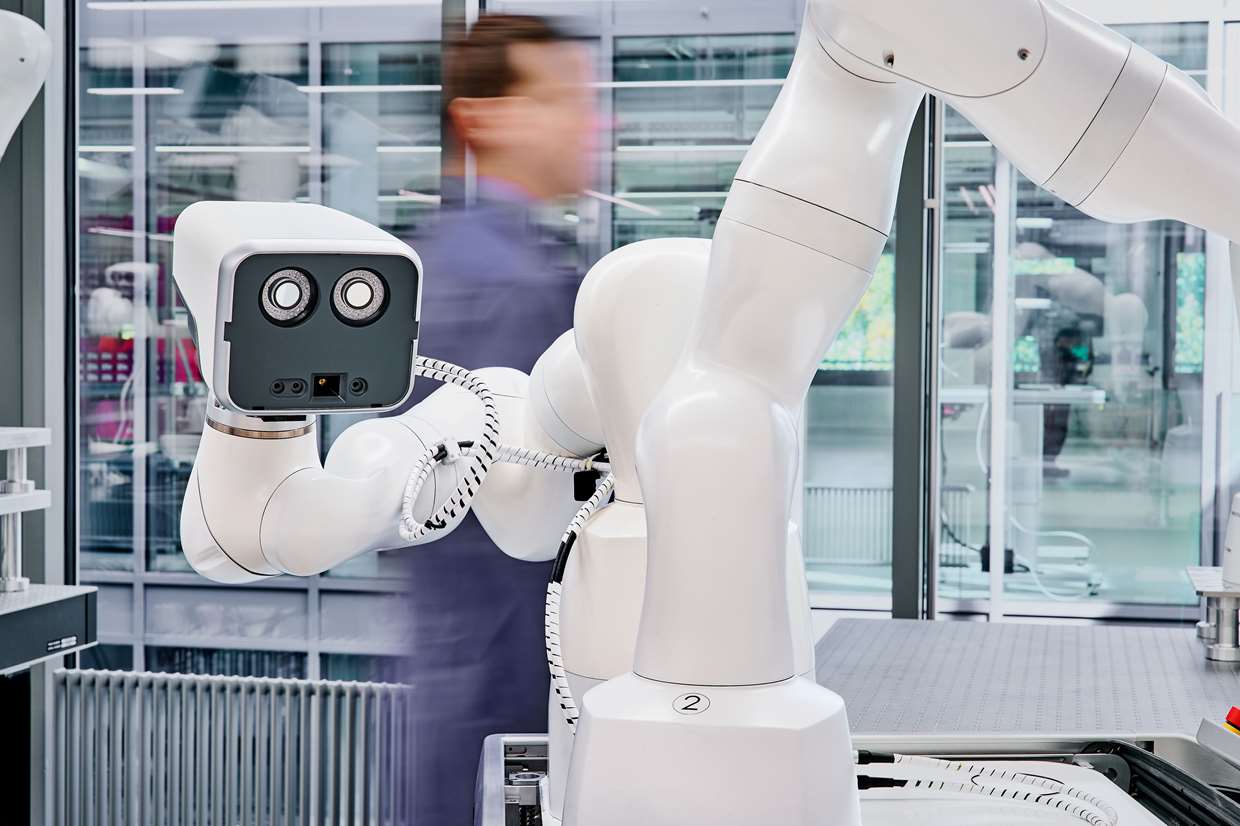

The successful letting at Morgenstrasse 136 in Bern-Bümpliz in the last quarter of the 2023/24 financial year was an important milestone. A new tenant was secured for the entire 2nd floor from July 2024: an innovative medical technology company, which will develop, manufacture and market robotic systems for spinal surgery at the site. The tenant fit-out implemented in the first half of 2024 was completed on time for the tenant to move in at the start of the lease. The lease for 1,781m² of lettable space has a term of 10 years. The WALT (weighted average lease term) of the property was 6.0 years as at the reporting date. The vacancy rate fell from 47.5% to 27.9%.

We are confident that this letting will have a positive impact on our ongoing marketing efforts with regard to the location and quality of the space on offer in the property.

New tenant in the Bern property

A space for pioneering developments in the field of robotic surgery

A modern, modular space concept for a target group of smaller companies as tenants was planned and implemented at Gewerbestrasse 12a in Egg in the 2023/24 financial year. After the balance sheet date on 31 March 2024, a 10-year rental agreement was concluded with a medical practice for part of the space (for 171m²) with effect from 1 September 2024. In addition, a new lease was signed for one of the smaller office spaces with effect from 1 September 2024.

Due to a change of tenant in the Zurich-Oerlikon located property at Hofwiesenstrasse 370, the vacancy rate is currently 10.3%. Time until re-letting is being used to renovate the rental space. Marketing efforts proved successful and the space could be re-let as of March 2025.

Major Tenants

Our major tenants are well-known companies and administrative bodies of the City of Zurich. These tenants account for just under half of our rental income.

Rental Contract Analysis

The chart illustrates the timeline of expiring leases based on the effective rental income (contract rent) and on the assumption that expiring leases will be extended or renewed at current market rents (market rent).

Strategic Alignment

Züblin continues to concentrate on selective investments in office properties in the strategically defined core markets in German-speaking Europe, with an emphasis on our home market of Switzerland. However, we will only make acquisitions if they meet the investment criteria we have defined, complement the portfolio sustainably and add value in the long term.