CFO Letter

Roland Friederich, CFO

Ladies and Gentlemen

Züblin closed the 2017/18 financial year with positive results. Adjusted earnings of CHF 6.6 million led to an increase in shareholders’ equity of 5.5 %. The reported loss of CHF 29.3 million reflects the release of reserves previously recognised in equity for cash flow hedges and discontinued operations. This reclassification has no impact on shareholders’ equity. The value of the real estate portfolio increased to CHF 200.1 million (previous year CHF 198.5 million) on the balance sheet date. The net yield on the real estate portfolio remained stable at 3.7%. The use of funds from the sale of the German portfolio resulted in a low loan-to-value ratio of 32.8% (previous year 54.5%) and a readily available credit line of CHF 52 million.

Adjusted income statement

A net loss of CHF 29.3 million was reported in the income statement. CHF 35.9 million of this loss resulted from reclassifications from equity to the income statement. However, these one-off accounting effects, known as “recycling”, had no impact on equity and are eliminated in the following adjusted income statement.

Rental income increased by 0.7% following new rentals in the Swiss portfolio. Net operating income (NOI) decreased by 1.6% due to higher repair and real estate expenses.

Based on the profitable operating results and the successful sale of the German portfolio the company made higher bonus provisions, which led to an increase in personnel expenses in the current financial year.

The increase in administrative expenses was mainly due to advisory expenses in connection with analyses of potential property purchases.

Earnings before changes in market value, financial expenses and income taxes (EBITDA) decreased by 14.1% to CHF 2.9 million.

The Swiss portfolio experienced a positive change in market value of CHF 1.5 million. Of this amount, CHF 2.0 million was attributable to three properties with positive changes; two properties were written down by CHF 0.5 million.

In connection with the refinancing of the Swiss portfolio, an interest rate hedging instrument taken out in 2010 with an expiry date of 2026 was also settled. As a result the financial expenses reported in the income statement include a reclassification of losses contained in equity in previous years. As this technical rebooking has no effect on equity, it has been adjusted in the table above.

The adjusted financial expense of CHF 1.6 million includes an expense of CHF 0.7 million incurred in connection with changes in market value up to the settlement of the financial instrument in September 2017. Future periods will no longer be affected by the financial instrument.

Adjusted earnings before taxes (EBT) of CHF 3.2 million decreased by 15.5% compared to the previous yearʼs figure.

Income taxes were reclassified from equity in connection with the settlement of the interest rate hedging instrument. This reclassification, which does not affect shareholdersʼ equity, was eliminated in adjusted income taxes. Compared to the previous year, adjusted income taxes decreased by CHF 1.2 million, of which CHF 0.8 million was due to the release of a tax provision after a final tax assessment.

Adjusted earnings from continuing operations rose from CHF 2.1 million to CHF 2.8 million.

Adjusted earnings from discontinued operations relate exclusively to the German real estate portfolio sold in August 2017. This item has also been adjusted for losses from currency translation and cash flow hedging instruments recognized in equity in previous years. These technical transfers from equity (reserves for discontinued operations) to the income statement have no impact on the level of equity. Adjusted earnings from discontinued operations of CHF 3.8 million derived from CHF 3.2 million of realized currency gains in connection with the repayment of shareholder loans as well as the operating results of the German division for the period April 2017 to August 21, 2017.

Adjusted earnings for the financial year 2017/18 of CHF 6.6 million correspond to adjusted earnings per share of CHF 1.99 (previous year CHF 9.02). Adjusted earnings from continuing operations amounted to CHF 0.83 compared to CHF 0.64 in the previous year.

While the effect of adjusted earnings is reflected in equity in full, the reclassifications from equity to the income statement have no impact. After the reclassifications of CHF 35.9 million, the net loss reported in the income statement amounts to CHF 29.3 million.

Balance sheet ratios

The balance sheet data and ratios as of 31 March 2018 are characterized on one hand by the stable Swiss real estate portfolio and on the other reflect the positive impact of the sale of the German real estate portfolio and the refinancing of the Swiss portfolio.

The investment properties continue to generate a stable net return of 3.7%. The vacancy rate of 10.1% fell from the previous year following new lettings, but still offers potential for increasing the net yield. The increase in market value by 0.8% or CHF 1.6 million reflects both new rentals and the local transaction market.

Mortgages borrowing fell by CHF 42.5 million compared to the previous year. In view of the ongoing negative interest rate environment, funds from the sale of the German portfolio were used to refinance the Swiss investment properties in September 2017. With the conclusion of a CHF 118 million five-year revolving framework loan agreement with a Swiss cantonal bank, Züblin is now once again financed on a long-term basis. Only CHF 66 million of the framework loan is currently drawn down, which means that an addtional CHF 52 million can be drawn at any time, for example for equity investments in future real estate acquisitions as part of the implementation of the growth strategy.

The financial strength of Züblin is solid. Equity increased by CHF 6.6 million. In addition to the positive adjusted earnings, the reduction in debt financing and the settlement of the interest rate hedging instrument led to a strengthening of equity and the equity ratio. As of 31 March 2018, the equity ratio amounted to 61.6% compared with 31.8% a year ago.

Share price

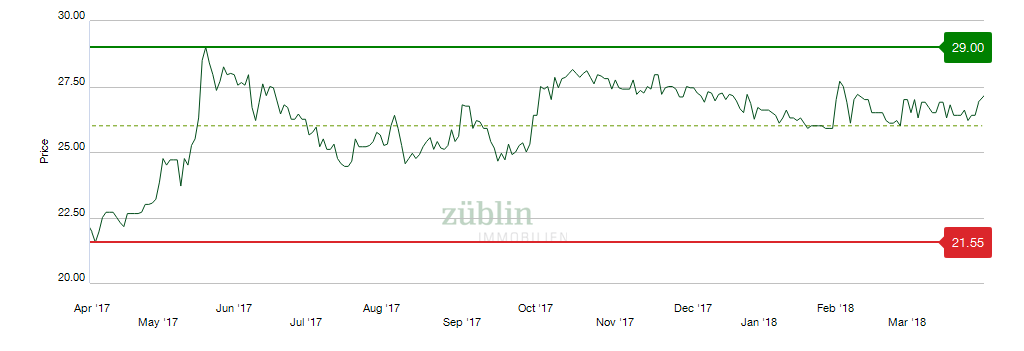

Development of the ZUBN share price in the financial year 2017/18

The share price performance in the financial year 2017/18 was 22.6%

The share price rose by 22.6% from CHF 21.95 to CHF 26.90 in the reporting year 2017/18. Net asset value (NAV) per share on 31 March 2018 was CHF 38.85. The share was thus trading at a discount of 31%.

Repayment of capital reserves

The restructuring of Züblin was successfully completed with the sale of the German portfolio and refinancing of the Swiss portfolio. The Board of Directors proposes that the accumulated loss of CHF 110.1 million for financial year 2017/18 be fully offset against existing statutory profit reserves and capital reserves. In addition, the Board of Directors proposes a dividend of CHF 1.00 nominal value per registered share (Namenaktie) of CHF 22.50 from the capital reserves. This results in a payout yield of 3.27% based on the share price on 31 March 2018.